|

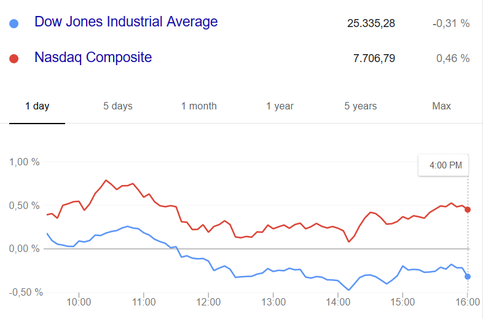

Equities had a mixed outing on Wednesday as investors took in the latest batch of corporate earnings and digested the Fed's latest policy directive. The S&P 500 and the Dow Jones Industrial Average finished with modest losses, shedding 0.1% and 0.3%, respectively, while the tech-heavy Nasdaq Composite climbed 0.5%. The Fed left interest rates unchanged as expected, keeping its target range at 1.75% to 2.00%, and characterized the economy as strong, signaling that the central bank is still on track to raise rates two more times this year. The next rate hike will likely come in September, with the CME FedWatch Tool placing the chances at 91.2%. On the corporate front, Apple (AAPL 201.50, +11.21) gobbled up all the attention after releasing its fiscal Q3 results on Tuesday evening. The world's largest tech company beat earnings and revenue estimates and issued positive guidance for Q4, helping to restore faith in FAANG names after a disappointing report from Facebook (FB 171.65, -0.93) last week. Apple shares rallied 5.9%, hitting a new record high and pushing the company's market cap to $990 billion -- within striking distance of the unprecedented $1 trillion mark. Underpinned by Apple, the information technology sector finished atop the sector standings, adding 1.0%. Only two other groups -- real estate (+0.7%) and health care (+0.1%) -- finished in the green. The financial sector got off to a good start, rising as much as 1.1%, but tumbled back to its flat line following news that Fidelity will be offering new index funds with zero fees, creating concerns over the future profitability of competitors like BlackRock (BLK 479.45, -23.31, -4.6%) and T. Row Price (TROW 117.27, -1.81, -1.5%). Meanwhile, the trade-sensitive industrial sector (-1.3%) slid following reports that the White House is considering upping planned tariffs on $200 billion worth of Chinese goods to 25% from 10%, and the energy sector (-1.3%) tumbled amid a drop in oil prices; WTI crude declined 1.5% to $67.68/bbl, a six-week low, after the weekly EIA inventory report showed an unexpected build of 3.8 million barrels. Source: Briefing.com

Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed