|

Earlier this year, we discussed the benefits of investing in precious metals, and several means of doing so (in this article). Given the strong rise in gold prices this year, we take another look at the best way to maintain exposure to this asset class.

Here are some practical ways you can increase your kids' financial literacy from the early years and set them up to win with money at any age.

O&G Capital Management is pleased to offer complete notarial services that are simplified and efficient! We have the ability to provide notarial services to all US citizens who require authorized documents per US law and policies set forth by the Department of State. Additionally, we offer notarial services to any individual of any nationality, as long as the document being notarized is required for use within the jurisdiction of the United States and abides by relevant US laws. In a landmark of Greek Culture & Lifestyle, the Hellas House takes a holistic approach to personal betterment engaging mind, body, environment and nutrition. The venue’s inspiration and passionate dedication towards empowering a healthier and happy life was the perfect setting for our event “Richest Women in Shanghai – Saving & Investing Your Way to Financial Freedom.” Pointedly, self-empowerment toward a healthier and happier financial life.

The Gold Standard Serving as the basis of economic capitalism, gold has always played a major role in the global economy. Although not a primary currency anymore, gold can be used as an integral tool in your portfolio and carries a variety of benefits: Store of Value & Inflation Hedge Compared to the USD that has lost 98% of its purchasing power since the Federal Reserve was established, physical gold has preserved value by consistently beating inflation. Unlike fiat and cryptocurrencies, gold is a tangible asset that cannot be hacked, forged or erased. Diversification Having a small portion of your portfolio dedicated to gold is an effective way to maintain a balanced portfolio over an economic cycle. Hedge against market crashes Gold has proven to balance equity losses during downturns, with the commodity rising nearly 70% of the time that stock markets fell over the past 50 years (across all 12 month periods).  With freshly made breakfast and exotic fruits filling the bar counter, O&G had the pleasure of welcoming life insurance expert Dr. Doyle Ray Oakey to the Shanghai Life Insurance Seminar 2019. Dr. Oakey has more than twenty years of global experience advising companies, individuals, and families on insurance, wealth and risk management products, process and preparedness. Today, he continues to advise insurance clients globally through his role in Primer Sol Consulting. Two sessions were held. A Monday morning session presented in English, and a Chinese counterpart on Tuesday with the same exceptional set-up accompanied by an experienced translator. The purpose of the seminar was ‘a client-centered approach’ where attendees from both presentations represented professional service firms, to identify their clients’ insurance needs. U.S. Federal Tax Filing Requirements:

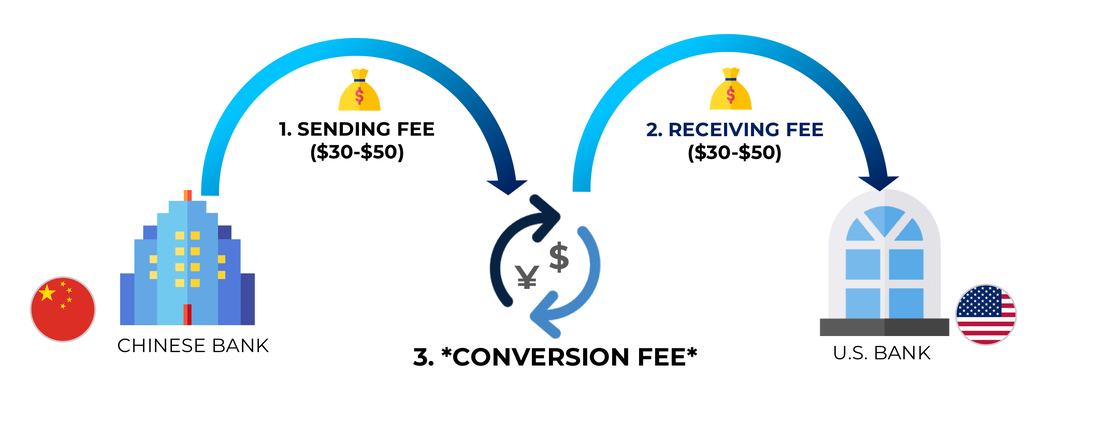

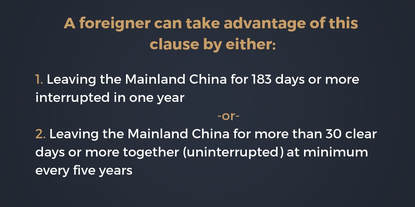

1. Employees with income exceeding $10,000/month 2. Self-employed individuals with income exceeding $400/month. Deadline: Any taxes due must be paid by April 15th, just like back in the U.S. Filing deadline is June 15th, with a further extension available until October 15th. Other requirements: 1. FBAR: must be filed for individuals with a combined balance exceeding $10,000 in accounts outside of the U.S. 2. Form 8938: must be attached to the annual return of individuals with foreign assets exceeding $200,000, excluding a home owned in your name (FATCA requirement). Sending fee, receiving fee and conversion fee. The common denominator is that they are unwanted and unavoidable. But what can you actually do to minimize these costs? When you send money abroad it would be profits from your company, payments to suppliers, or for personal reasons. When doing this, you must make a conversion from RMB to your home currency. HOW DOES REPATRIATION WORK?Great News! Five Year Rule for Expats Still Remains (and other Individual Income Tax (IIT) Updates)In this article, we will address additional information about a couple of important uncertainties to the new tax policies that were previously not addressed. We will assume that you are already familiar with the basic details such as the increase in the non-tax salary exemption, the changes to rates and deductible categories, etc. If not, please click here. Five Year Rule Remains

The Fluctuating RMBI came to China for the first time in 2006 and immediately began soaking up the country’s rich culture, people, and cuisine. I took the 8:1 USD/CNY exchange rate for granted, and accepted strong dollars as being one of the many perks of life abroad. After spending the next five years in the states to finish school, I returned to China in 2013 to find the exchange rate had shifted to 6:1, the USD had declined in relative value by 25%! Flash-forward to today and the USD has bounced all the way back up to about 7:1.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed