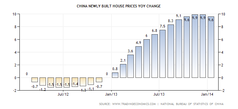

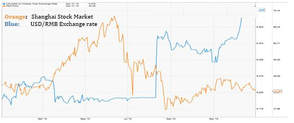

An IPO (Initial Public Offering) is the process in which a company first gets listed on an exchange, and starts trading as a stock for the public to buy and sell. Companies IPO in an effort to raise investor money, by sharing ownership of their firm with the public. The popular electronics company, Xiaomi (SEHK: 1810), completed its long awaited IPO on July 9th, and the road has been bumpy. In an effort to raise capital and ensure a successful IPO, Xiaomi positioned itself as more than just a smartphone and hardware company, but instead as an “Internet servicing company”.  As the largest players in their respective markets, Alibaba (NYSE: BABA) and Amazon.com (NASDAQ: AMZN) have garnered investor attention, both growing more than 100% over the past several years. In the wake of this gold rush, China’s highest quality direct-to-consumer company, JD.com, has lagged.  The nearly uninterrupted move since April saw the Yuan weaken 7.5%, from 6.25 to a low of 6.72. The currency has since retraced to 6.63 at the time of writing, however the past month remains the biggest one-month move in recent years. This devaluation comes during trade war talks and puts pressure on the US, as Chinese products become significantly more expensive.  Alphabet Inc. (NASDAQ: GOOG) is acquiring 27million shares of JD.com Inc. (NASDAQ: JD) at a price of $40.58 per ADS (each ADS is equal to two shares), a premium to yesterday’s closing price of $39.18. This deal will provide JD with cash to expand its logistics capabilities, and the two companies will work on initiatives that combine Google technology with JD’s existing infrastructure.  The junior gold miner ETF has gotten too big for its own good; The inflow of money has created a serious problem for GDXJ; It simply has too much capital in proportion to its limited market space (Exhibit 1) The ETF's index is making changes that will cause performance to drag, and its mission to creep.  Real estate in China has experienced astonishing expansion during the recent years, and many factors have helped push prices 10% higher this past year. shows the surge in prices: How long are these increasingly rising prices sustainable? The Chinese government has taken multiple steps to stem prices. In the past few years, the government has enacted laws to set home price ceilings, second home purchase restrictions, slowdowns in bank lending, and have vastly increased the supply of government-subsidized houses. The most recent plan is a steep new tax on home sellers of up to 20%.  March 1st: Signs of weakness China PMI shows manufacturing activity shrank for a second straight month. 2015 GDP growth target is set at 7%, the lowest in 11 years. China’s new model focuses on quality of economic growth over quantity of economic growth.  The Chinese Renminbi has been on the news a lot lately, both positively and negatively. The surprise devaluation in August shocked markets worldwide, while the inclusion of the RMB in the basket of international reserve currencies (Special Drawing Rights) of the International Monetary Fund was received on a more positive note. In this first part we will discuss the history of the people’s currency. |

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed