March 1st: Signs of weakness China PMI shows manufacturing activity shrank for a second straight month. 2015 GDP growth target is set at 7%, the lowest in 11 years. China’s new model focuses on quality of economic growth over quantity of economic growth. May 10th: Stimulating the market

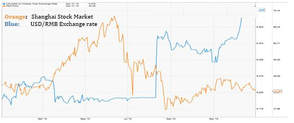

In efforts to stimulate the economy, Beijing cuts bank reserve requirements by 1%, the largest reduction since 2008. The benchmark one-year lending rate is also cut by 25 basis points to 5.1% and the deposit rate by 25 basis points to 2.25%. These efforts kick start a frenzy of speculative investment. June 12th: Market Peak Despite a slowing Chinese economy, the Shanghai Stock Index sees a meteoric rise. By June 12th, the market peaks at growth of over 63% for the year, a yield of over 120% annually. Exuberance for Chinese stocks are not backed on fundamentals, instead growth surges through a combination of government stimulus and investor euphoria. July 8th: First Crash By the 8th-9th of July, the Shanghai market has fallen 30% over three weeks, with half of all public companies filing for a trading halt in an attempt to prevent further losses. Investors using borrowed money face margin calls, and are forced to sell shares, precipitating the crash. August 11th: RMB Devalues to 6.4/USD China surprises the world by devaluing the Yuan by nearly 2% in one day, as the currency sees the largest daily fall since the country established a currency market in 1994. In the days that follow, the PBOC says there is no basis for a sustained depreciation in the Yuan, yet orders state banks to buy the Yuan on behalf of monetary authorities. August 25th: Second Crash Another equity selloff occurs, as the Shanghai index sees an over 40% crash since June. Concerns in China, extremely low oil prices, and interest rates leads to a 10% crash in the US market as well. October 19th: Slow Growth The Chinese market stages a modest recovering, however reports the slowest 3Q growth results since 2009. In the month of September, exports fall by 3.7% imports decline 20.4% year over year. November 30th: IMF Approval The IMF approves the Yuan as a reserve currency, and is now accepted as an official global currency. The controversial addition recognizes the significant reforms in the Chinese economy. In the same month, IPO’s are resumed in China for the first time since the halt in July. January 4th (2016): Weakened Yuan- 6.51/USD The RMB ends the year at an exchange rate of 6.51 to the USD, the weakest since 2011, and continues to trend downwards. Despite a recovery from the stock market lows seen in August, we are reminded that volatility remains as the Chinese index closes -7% on the first day of trading in 2016. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed