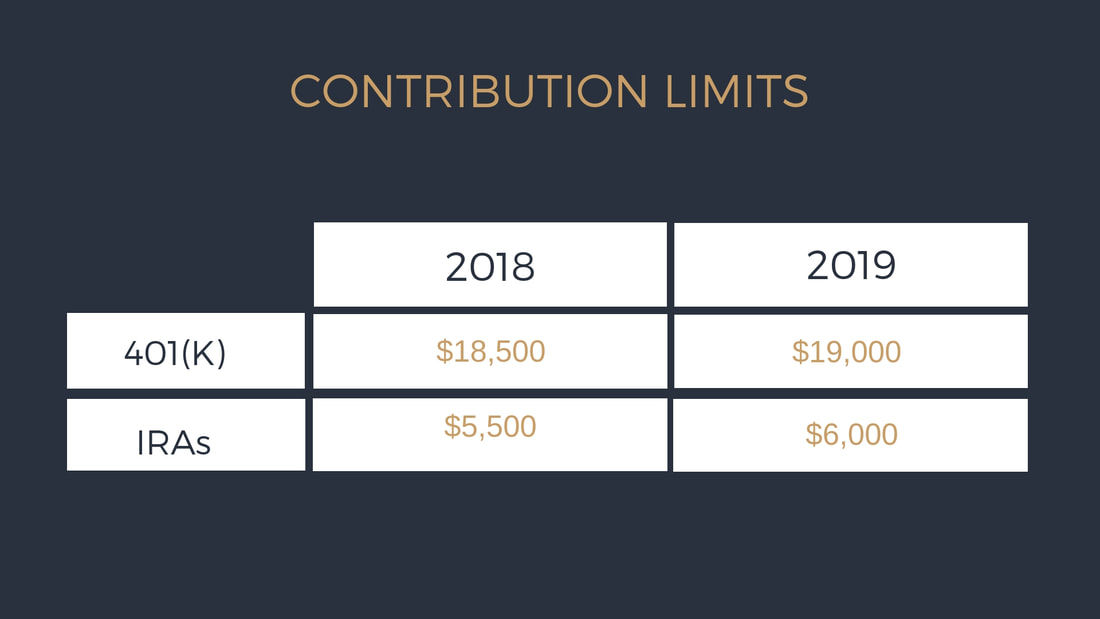

This is the first contribution limit increase since 2013 for IRAs and provides significant benefits. As an example, if we assume 8% returns, the updated $500 limit in retirement savings over 35 years is $100,000. Tax-deferred investment accounts such as IRAs and 401(k)s are powerful tools, that offer greater comfort in life and retirement. Click on more O&G content to learn the ins and outs. Important Note: You can begin contributing to your IRA under 2019 limits on January 1, 2019. However, if you still haven't met your 2018 limit, you have until April 15, 2019, to max out.

Send us an email at max.greb@olivar-greb.com if you have any questions or call at +86 131 2206 9291 to schedule an informative meeting. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed