|

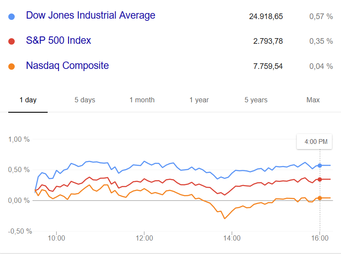

The market climbed for a fourth straight session on Tuesday, with the S&P 500 and the Dow adding 0.4% and 0.6%, respectively. The tech-heavy Nasdaq lagged, but still managed to eke out a narrow victory, and the small-cap Russell 2000 ended lower by 0.5% despite hitting a new intraday record in early trading. 10 of 11 sectors finished Tuesday in the green. Defensive groups, including consumer staples (+1.3%), utilities (+1.0%), and telecom services (+1.1%) led the charge after lagging on Monday. The energy (+0.7%) and materials (+0.8%) groups were also strong, but the heavily-weighted financial space (-0.4%) struggled following Monday's rally.

The trade war between the US and China seems to be catching steam as Donald Trump announced an additional $200 billion of potential tariffs after both countries already imposed $34 billion worth of tariffs on each other’s’ exports. The markets have been waiting for clarity on this trade war, and the declines in futures and Chinese markets after the announcement show that traders think it is for real this time. As a reminder, there never is a winner in a trade war. This tit-for-tat approach can turn into a negative loop that will be very harmful for both economies. Source: Briefing.com Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed