|

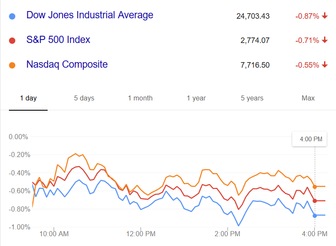

Stocks snapped a four-session winning streak on Wednesday as U.S.-China trade tensions retook center stage and as crude oil prices tumbled, weighing on energy shares. The S&P 500 dropped 0.7% to 2774, the Dow Jones Industrial Average declined 0.9% to 24700, and the Nasdaq Composite slid 0.6% to 7717. Meanwhile, in Brussels, a two-day NATO summit got off to a contentious start after President Trump criticized Germany for approving a major gas deal with Russia. NATO leaders later recommitted to a military spending target of 2% of GDP by 2024 at the urging of Mr. Trump, who was pushing for doubling the target to 4%.

Back on the home front, energy stocks tumbled as crude prices retreated from a three-and-a-half year high. Several factors contributed to the crude sell off, including a muted/negative response to a bullish inventory report, which showed a huge drop of 12.6 million barrels -- the biggest weekly drop since September 2016. WTI crude futures tumbled 5.0% to $70.38 per barrel, and the S&P 500's energy sector declined by 2.2%, closing at the bottom of the sector standings. The industrials (-1.6%) and materials (-1.7%) spaces, both of which are sensitive to trade issues, were the next-worst performing groups, while most other spaces lost no more than 0.8%. Out of 11 groups, the utilities space (+0.9%) was the only one to finish in the green, continuing to rebound from Monday's 3.1% drop. Source: Briefing.com Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed