|

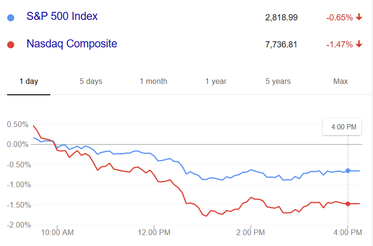

Stocks started Friday stable, but began tumbling in the afternoon, with tech shares pacing the broad-based retreat. The tech-heavy Nasdaq dropped 1.5%, ending the week lower by 1.1%. The S&P 500 and the Dow also declined, losing 0.7% and 0.3%, respectively, but managed to keep in positive territory for the week (+0.6%; +1.6%). The small-cap Russell 2000 under-performed (-1.9%), extending its weekly loss to 2.0%. All eyes were on Amazon (AMZN 1817.27, +9.27) coming into Friday's session, with investors hoping that its better-than-expected Q2 earnings report could restore some faith in FAANG names, which lost a lot of momentum on Thursday due to Facebook's (FB 174.89, -1.37) earnings-induced plunge. Amazon was up around 4.0% in pre-market trading, but weakened substantially intraday, trimming its gain to just 0.5% by the closing bell. The petering out didn't do much good for the bulls, which, just a few days ago, were looking to ride another FAANG-led rally back into record territory. The top-weighted technology sector finished a way behind the ten other groups on Friday, losing 2.0%. Intel (INTC 47.68, -4.48, -8.6%) weighed heavily on the group as concerns over its slow roll out of next-generation chips overshadowed its better-than-expected Q2 earnings report. Twitter (TWTR 34.12, -8.82) was also a drag on the tech space, plunging 20.5%, after reporting a decline in monthly active users and disappointing guidance. Source: Briefing.com

Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed