The Education Planning Process

|

College tuition costs can be a massive financial burden. According to the Federal Reserve, the total amount of student debt is now over 1.3 Trillion Dollars. With the average private university costing $33,000 USD per year, it pays to get a head start on higher education savings.

Olivar & Greb Capital Management provides long term, intelligent advice for families with the proactive mindset to start saving for their children's future. |

We use a 4-step process to college financial planning. Read below to learn more about our

personalized approach:

Step 1: DETERMINE YOUR SITUATION

You'll sit down with our team for an initial "fact find" meeting. Here we'll go through all the details of your individual situation such as:

- Future Funds Needed

- Time horizon

- Household Cash Flow Statement and Balance Sheet

- Current Asset Allocation

Step 2: PRESENT AN ACTION-ORIENTED PLAN

Once our team has fully researched and analyzed your individual situation, we present your options to you in a report that details an action plan of how to proceed.

In this report we detail:

In this report we detail:

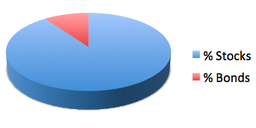

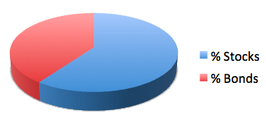

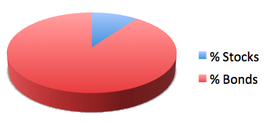

- Our proposed asset allocation plan for the duration of the plan

- The minimum monthly contribution needed to reach your goal

- Projected household cashflow statements

Step 3: PORTFOLIO & STRATEGY MANAGEMENT

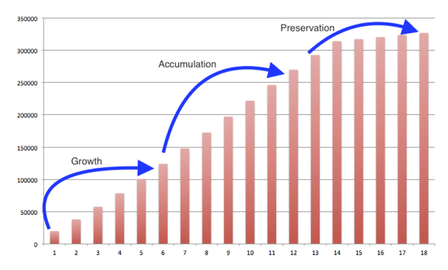

Our investment and research teams break down your plan into three phases. Our experienced investment team shifts your portfolio from growth to capital preservation as college approaches. Using proprietary research and portfolio construction, our dedicated team of investment professionals creates a portfolio that will cater to your specific situation. Learn more below: