|

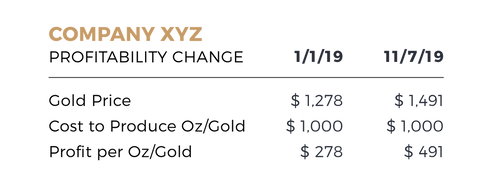

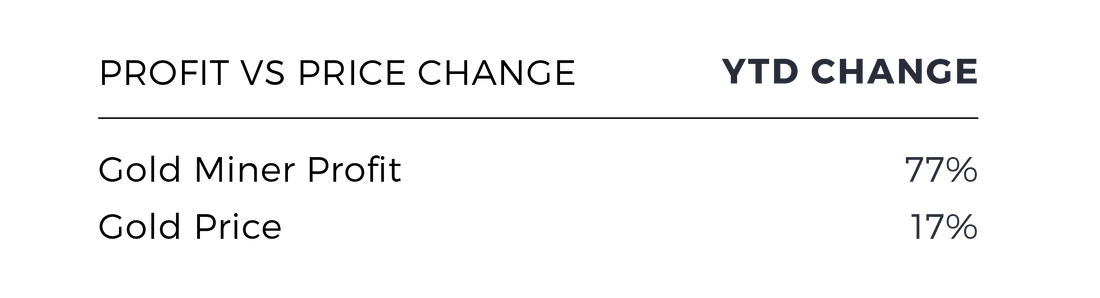

Earlier this year, we discussed the benefits of investing in precious metals, and several means of doing so (in this article). Given the strong rise in gold prices this year, we take another look at the best way to maintain exposure to this asset class. Investing in physical bullion can be complicated for the everyday investor, so we’ll be focusing on options 2 & 3: Gold mining stocks (GDX) which track the performance of mining companies, and physical prices (GLD), which track the actual commodity price. Gold mining companies are leveraged to the price of gold and are ideal when prices are rising (which has happened this year). Tables 1 & 2 illustrate how profit margins for a gold mining stock increase dramatically as a result of this leverage. For this example, we assume the cost to produce an ounce of gold for this mining company is $1,000/oz, which is about average. In practice, the cost generally remains unchanged with gold price fluctuations, therefore, is kept constant at $1,000. Notice how profits have increased 77% per ounce of gold since the start of this year, a profitability increase that was achieved when the price of gold itself only increased 17%. GLD & GDX PerformanceMoving forward, we determine if gold miners are still poised to outperform. The mining industry is notoriously challenging; here are some common issues:

These flaws have led to a loss in shareholder value over the long-term. Figure 2 shows that the price of gold is up 120% since 2006, while the mining ETF has declined 30%. With this in mind, it’s important to be intentional with this type of holding.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed