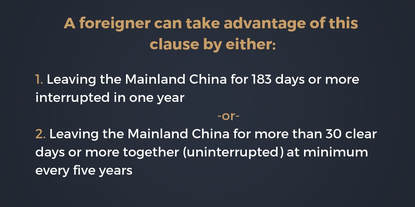

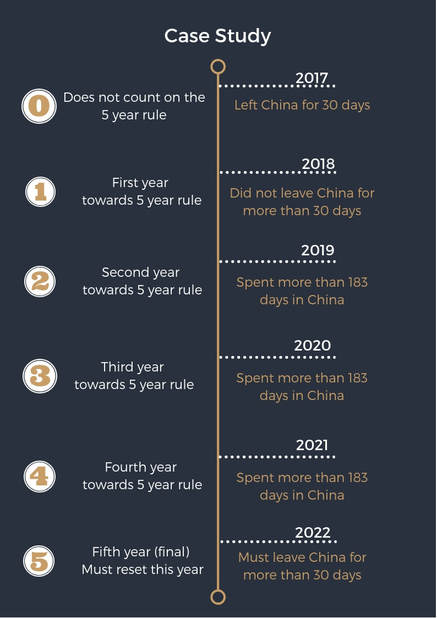

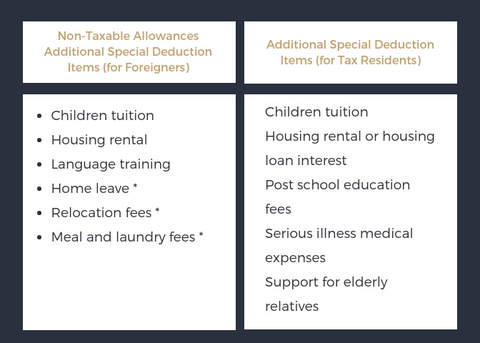

Great News! Five Year Rule for Expats Still Remains (and other Individual Income Tax (IIT) Updates)In this article, we will address additional information about a couple of important uncertainties to the new tax policies that were previously not addressed. We will assume that you are already familiar with the basic details such as the increase in the non-tax salary exemption, the changes to rates and deductible categories, etc. If not, please click here. Five Year Rule RemainsIf either of these two cases occurs then, the person's clock will reset. Please note that the day of departure and the day of arrival are considered days in China. Let’s have an example: If I left China in 2017 for more than 30 days, not including the day of arrival and departure, then when would I need to leave China next? If I don't leave China in 2022, then I will be considered a China tax resident starting in 2023, and will be subject to paying Chinese taxes on worldwide income and assets. If I leave earlier than 2022, then my clock will reset earlier. Earlier this year, we heard about big changes to the Chinese tax policies. Below are the major bullet points: 1. Consolidation of income categories 2. Modifications of tax percentages for income categories 3. Taking into account income that is not just sourced from an employer (e.g. self-disclosure of additional income sources) 4. Additional tax deduction categories 5. Change to a tax filing and reconciliation system 6. Shift to a self-reporting system rather than company based, which is similar to the American system (monthly filing before the 15th of each month and annual reconciliation and tax payment or refund between March 1 and June 30 of the following year) 7. Introduction of anti-tax avoidance policies. Some of these policies have been in effect since the first of October of this year; however, it will go into full effect on January 1, 2019 – just a couple of weeks away. The main goal of the new income tax policy is to reduce the burden for China’s middle class and increase income distribution. Tax Deductible CategoriesThe below table reminds us of the tax-deductible categories for both tax residents and non-residents. With this said, the Chinese Government has now made it clear as to the deductible expenses and caps. *Still Uncertain Source: Grant Thorton It is expected that some more detail will come near the end of the year. Follow us by scanning the QR code and stay tuned for upcoming updates. Other Current Uncertainties1. Calculation of taxes for annual bonuses 2. Calculation of taxes for equity incentive plans 3. One time severance payment tax calculations 4. If home leave, relocation, and meal and laundry fees will be tax deductible for foreigners. Some think it will be included still others disagree. 5. Details regarding the form that is required for foreigners who are not permanent residents to take advantage of the five-year (e.g. if it is a filing matter or an application and all of the related details regarding executing and processing this form) 6. How matters that exist outside of China are handled within China that China does not recognize (e.g. trust accounts) 7. If non-China tax residents will be allowed to make such tax deductions on individual returns, should their employer not provide an allowance. We think these will not be deductible as non-tax residents in other countries are not allowed to itemize and make deductions. Recent Bank Form Many people have been mentioning on WeChat these days about a message from their banks regarding a form concerning their tax residency location. We would like to remind people that this does not relate to the new Individual tax policies for China, but rather relates to the reporting and sharing of information between your home government and China.

With special thanks for contributions to David Yen, a California certified CPA who operates U.S. Abroad Tax, a Shanghai-based boutique consulting firm specializing in tax advisory and tax compliance services for American expats and American Green Card holders. He has extensive experience in resolving complex tax issues for individuals and small businesses in a well-informed and holistic approach. About the Author: Julian runs a company that works with individuals and organizations doing business between the US, China, and Africa. He has been based in China for a number of years. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed