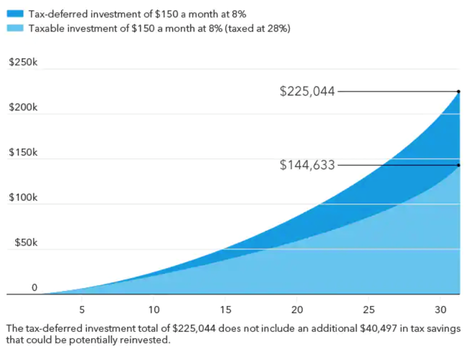

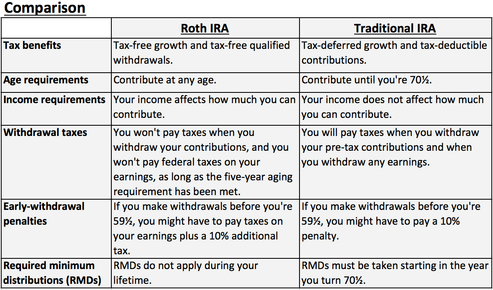

IRAs are powerful tools available to American individuals, allowing them to save for retirement with tax-free growth, or on a tax-deferred basis. They are vastly under utilized because many people don’t understand how they work. We break down the basics below. The Power of Tax Deferred InvestingThe following chart demonstrates how, all else being equal, tax deferred investing leads to significantly greater returns. Source: Capital Group Co. Frequently Asked QuestionQ: Is my money locked up until I reach retirement? A: No Many have avoided opening an IRA because the thought of not being able to touch their hard earned money until they’re 60 years old is unacceptable. This is a valid concern, and investment plans with a lock-in period should generally be avoided. The truth is that a Roth IRA allows the owner to withdraw 100% of contributions at any time, without any penalties or additional taxes. For example, if you invest $100,000 into your Roth IRA, and decide you need that money several years later, the full amount is available to you. Early withdrawals on the earnings are subject to a 10% penalty, however even these can be withdrawn penalty-free in some situations, such as: - Your first home purchase - Qualified education cost for yourself, spouse, children, or grandchildren. - And many more Note: Contributions and earnings withdrawals from a Traditional IRA are typically subject to a 10% penalty, however the same Roth exceptions apply. Q: If I already have a 401(k), can I still save in an IRA? A: Yes Taking advantage of employer sponsored retirement plans such as a 401(k) is a great way to save money for retirement, however it should be used in tandem with an IRA strategy. IRAs often provide greater investment flexibility, and having a Roth IRA alongside your 401(k) can provide much needed tax diversification. Since you’ll owe taxes on 401(k) withdrawals during retirement, tax-free money from your Roth can act as a buffer that could let you avoid a higher tax bracket. Q: Are IRA investment choices limited? A: No IRAs are often wrongly associated with CDs and other bank products. Banks that offer these products have incentive to market IRAs in this way, but the reality is that an IRA is like any other brokerage account. While 401(k) investments are often limited to costly mutual funds, IRA investment choices range from stocks and bonds, to derivatives such as futures and options. In fact, due to the tax shield on capital gains, we often recommend trading that has higher capital appreciation potential, to be done within an IRA. Since taxes are not accounted for until distribution, an investor also has the freedom to buy and sell as frequently as desired within the account, without worrying about short-term capital gain taxes. Roth IRA vs. Traditional IRARoth IRAs are similar to Traditional IRAs; the main difference is when the tax is taken out. Roth IRAs are taxed before contributing; Traditional IRAs are taxed at retirement. See more comparisons below: Source: Fidelity A Note on 401(k) Rollovers:

A 401(k) rollover is the process of moving your retirement savings from an employer-sponsored plan, into an IRA. This process allows you to keep your tax-deferred savings, while typically providing broader investment choices. Before making a decision, it is important to consider all tax implications, fees, and penalties. Learn more: Ultimately, the type of IRA you choose can have a significant impact on your long-term retirement savings and future financial goals, and understanding your options is critical. For more information or if you have any questions or comments, please reach out to our expert Max Greb at [email protected]. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed