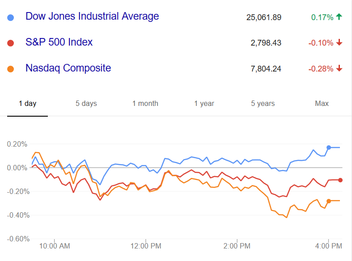

President Trump capped a week-long trip to Europe by meeting with Russian president Vladimir Putin in Helsinki, Finland. The leaders met for roughly four hours, discussing a wide range of topics, including arms control, the future of Syria, and, of course, Russian interference in the 2016 U.S. election, which Mr. Putin again denied. The market had a muted reaction to the summit.

Back on the home front, energy (-1.2%) was the worst-performing sector on Monday amid another dive in crude prices. WTI crude futures dropped 3.8% to $68.34/bbl and are now 7.8% below the nearly three-and-a-half year high they touched last week. The widely cited catalyst was a Friday comment from Treasury Secretary Mnuchin, who said some countries may receive waivers to continue buying oil from Iran. However, several other factors -- including restored Libyan production -- were also at play. Netflix, one of the most popular stocks in the market, reported earnings that were well below expectations after the market closed yesterday. Their subscriber growth, arguably the most important metric for Netflix, dipped sharply this quarter. New subscribers in the US totaled 670,000, vs. expectations of 1.21 million. International new subscribers also missed estimates by a large margin; 4.47 million vs. over 5 million expected. The stock declined 14% in after hours and is the first of the FAANG (Facebook, Apple, Amazon, Netflix, and Google) to decline significantly following earnings. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed