Overall gains were modest in scope, yet they were big with respect to engendering some confidence in the notion that the S&P 500 may be poised to take a run at the all-time high it hit in January (2872.87).

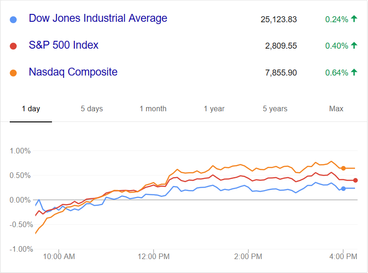

The Nasdaq Composite increased 0.6% and closed at a new record high; the Russell 2000 and S&P Midcap 400 Index advanced 0.5%; the S&P 500 jumped 0.4%; and the Dow Jones Industrial Average added 0.2%. Netflix was the top story stock of the day. It had been down as much as 14.1% after reporting disappointing subscriber growth for the second quarter and issuing disappointing third quarter guidance. Shares of NFLX, however, started to rebound as quickly as they fell at the opening bell. Elsewhere, Capitol Hill was a focal point today as Fed Chairman Powell appeared before the Senate Banking Committee to deliver his semiannual monetary policy report. Mr. Powell covered a range of topics in the Q&A portion of the testimony, yet there was nothing that was ultimately surprising in his remarks, which included a contention that there were growing concerns among business contacts about trade issues. The Fed chair reiterated the view that improving economic conditions should allow for continued gradual rate hikes. On a related note, the yield on the 2-yr note increased one basis point to 2.61% and the U.S. Dollar Index increased 0.5% to 94.97. Market participants seemed to appreciate Mr. Powell's calm, but confident, delivery, and the recognition that his remarks didn't introduce any volatility into the marketplace. Source: Briefing.com Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed