Investors received a heavy dose of corporate news, most of which was earnings related. IBM (IBM 149.24, +4.72, +3.3%) and Taiwan Semi (TSM 39.81, +1.40, +3.6%) climbed after reporting their quarterly results, but American Express (AXP 100.17, -2.81, -2.7%), eBay (EBAY 34.11, -3.84, -10.1%), Travelers (TRV 125.18, -4.82, -3.7%), BNY Mellon (BK 52.73, -2.91, -5.2%), Philip Morris (PM 80.90, -1.25, -1.5%), and Alcoa (AA 41.56, -6.40, -13.3%) all sold off.

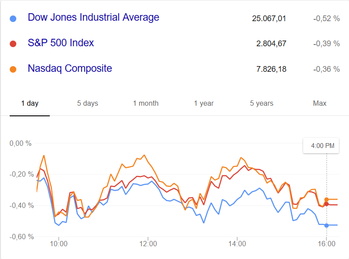

U.S. Treasuries rallied on Thursday, pushing yields lower across the curve; the benchmark 10-yr yield dropped three basis points to 2.85%. In Washington, President Trump criticized the Fed in a recorded CNBC interview, saying he's "not thrilled" about interest rate hikes. Mr. Trump's comments were seen as controversial as presidents typically refrain from speaking on monetary policy. The White House quickly issued a response to the criticism, saying the president respects the Fed's independence. During the same interview, Mr. Trump also commented on the strengthening dollar, saying it puts the U.S. at a disadvantage. The U.S. Dollar Index was up 0.4% at a 12-month high before the president's comments, but gave it all back and then some in a knee-jerk response. The Index was back in the green at Wall Street's closing bell, however, up 0.2% at 95.00. Source: Briefing.com Graph: Google finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed