|

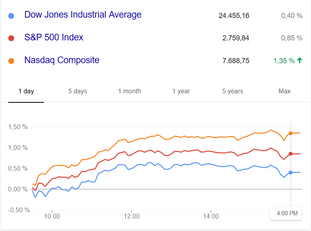

Apparently, a trade war started on Friday -- or so it was said -- yet the stock market acted as if there was a daisy stuck in the barrel of every trade threat. For the second day in a row, the stock market ignored the trade conflict between the U.S. and China (and other countries for that matter) and rallied around a pleasing employment report for June. It was clear to see in the futures market this morning how the employment report was the inflection point for a shift in trading sentiment. Prior to its release at 8:30 a.m. ET, the S&P futures were down as many as seven points and signaling a modestly lower start for the broader market.

Following the release, they turned positive, and although the open to today's session was a bit tentative, the bulls soon took command of today's tape, ceding some ground only in a profit-taking retreat in the last 30 minutes of trading. The catalyst for the upside bias was the recognition that the June employment report had a familiar Goldilocks hue to it. Specifically, it featured solid non-farm payrolls growth (+213,000) and a subdued 2.7% year-over-year gain in average hourly earnings that kept inflation worries, and aggressive rate-hike worries, at bay. The stock market wasn't the only beneficiary of that fairy-tale theme. The Treasury market also enjoyed the not-too-hot-not-too-cold narrative. The 2-yr note yield, which is more sensitive to changes in the fed funds rate, fell three basis points to 2.53% while the 10-yr note yield, which is more sensitive to inflation, slipped one basis point to 2.83%. Source: Briefing.com Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed