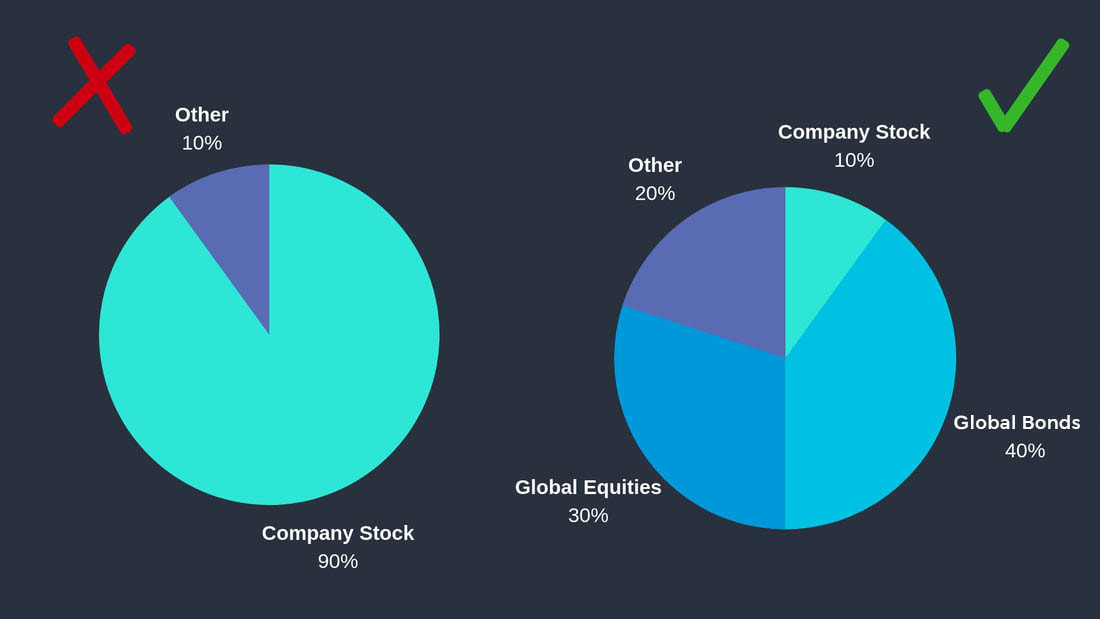

What are employee stock options?Employee stock compensation comes in many different forms. Some require a vesting period before an employee can cash out, while others act as stock options, allowing the employee to purchase the employers stock in the future (often at a more attractive price). Whichever type of stock award has been granted, employees deal with the same situation: they are too heavily concentrated in their current (or previous) employer’s stock. All your eggs in one basketDuring bull markets, employees who are compensated in stock options excitedly watch their net-worth grow. Having a high percentage of their net worth tied up in a single stock seems to be working, why make a change? Bull markets end. Take General Electric (NYSE: GE) as an example. From 2009 - 2016, the conglomerate grew steadily, with little reason to believe things would change. Over the past two years, GE has declined by over 80%. Employees, who didn’t take the initiative to diversify, have sadly experienced significant declines in their net worth. Investigating the big picture is an important first step, and it often can point out misalignment in overall asset allocation. If you have any questions, please email me at:

[email protected]. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed