|

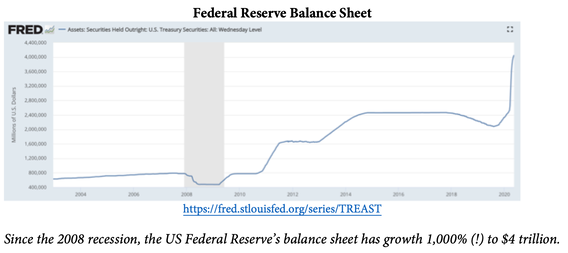

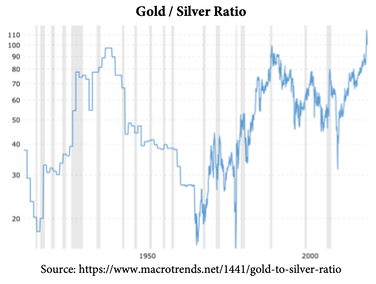

This week’s column is all about Silver. Precious metals often act as a hedge against the stock market and are integral components to a balanced portfolio. In today’s uncertain world, finding ways to minimize risk is even more critical, and the main reason these metals are drawing more attention. Gold: The price of gold has seen a dramatic 37% year-over-year price increase, reaching $1,750/oz at the time of writing. Meanwhile, Bank of America just increased their 18-month price target to $3,000/oz, a 70% gain from here. “As economic output contracts sharply, fiscal outlays surge, and central balance sheets double, fiat currencies could come under pressure” the firm says, adding “Investors will aim for gold.” With economies facing enormous challenges, this is a plausible scenario. The case for Silver: Referred to as the “poor man’s gold”, silver is generally levered to the price of gold. When gold goes up silver outperforms, and when gold goes down silver underperforms. Notice how silver (red) drastically outperformed from 2008 to 2015 when both rose, and loss significantly more than gold (blue) from 2011 – 2015 when they both declined. Given this relationship, we would expect silver to have gained momentum over the past couple years while gold has accelerated. Instead, its price has stagnated and appears undervalued. The Gold/Silver ratio confirms this assumption. Gold/silver ratio: the amount of silver it takes to purchase one ounce of gold Per the following Gold/Silver Ratio chart, silver is trading at its cheapest price in relation to gold over the past 100 years. An investor would need 100 ounces of silver to buy 1 ounce of gold. In Summary:

The pandemic has caused significant disruptions. The deflationary pressures of a frozen global economy are being combatted by a newly printed money supply that has flooded the market. It’s difficult to measure if this monetary policy will be enough to support the economic fallout, so caution is warranted. Given the amount of money printing and the above-mentioned technical indicators, precious metals offer distinct diversification and hedging capabilities throughout this time period. Final Notes: Commodity trading is not suitable for all investors; silver in particular is highly volatile. In the first three months of 2020, Silver was down 35%. Position sizing is critical. Here is how we gain exposure to the metals.

Author: Max Greb, Portfolio Manager Please reach out to Max with questions, comments, and requests at [email protected]. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed