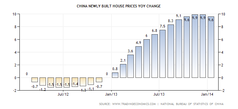

Real estate in China has experienced astonishing expansion during the recent years, and many factors have helped push prices 10% higher this past year. shows the surge in prices: How long are these increasingly rising prices sustainable? The Chinese government has taken multiple steps to stem prices. In the past few years, the government has enacted laws to set home price ceilings, second home purchase restrictions, slowdowns in bank lending, and have vastly increased the supply of government-subsidized houses. The most recent plan is a steep new tax on home sellers of up to 20%. As you can see, prices seem to be cooling off. The year over year increase has started to drop from 9.6%. Hopefully this is a direct effect of the new policies. While a decrease in price change seems promising, 9% is still an alarmingly high number, comparable to taking a Porsche down from 200 to 180mph.

Given the conditions in China in the past 5-10 years, it isn’t surprising for such high increases in real estate prices. A combination of poor stock market returns, low interest rates, high urbanization, and steadily increasing property prices has proven to Chinese investors that real estate is a safe haven. Over 60% of household assets are in real estate, and these investments account for 11% of China’s total GDP. Because China, as the world’s second largest economy behind the United States, now plays an increasingly important role in global demand for goods, any news from the government about dampening the housing market sends reverberations through all markets. The recent prices signals “bubble” to most. If you ask a native Chinese citizen about a pending bubble bursting, the most common answer you’ll hear is “The Chinese government is too strong to allow a collapse to occur”. However when you ask a Westerner, they’ll come back with “We thought the US was too strong to collapse too, and look what happened”. Our advice, stay away from real estate in China for now. As prices have seemed to cool down, we advise waiting to see how well the Chinese government can manage this delicate balancing act. Instead, we recommend investing in a diversified portfolio to take advantage of the value in sectors like water, infrastructure, and the US small cap market. Sources: National Bureau Statistics of China, Bloomberg, NY Times Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed