|

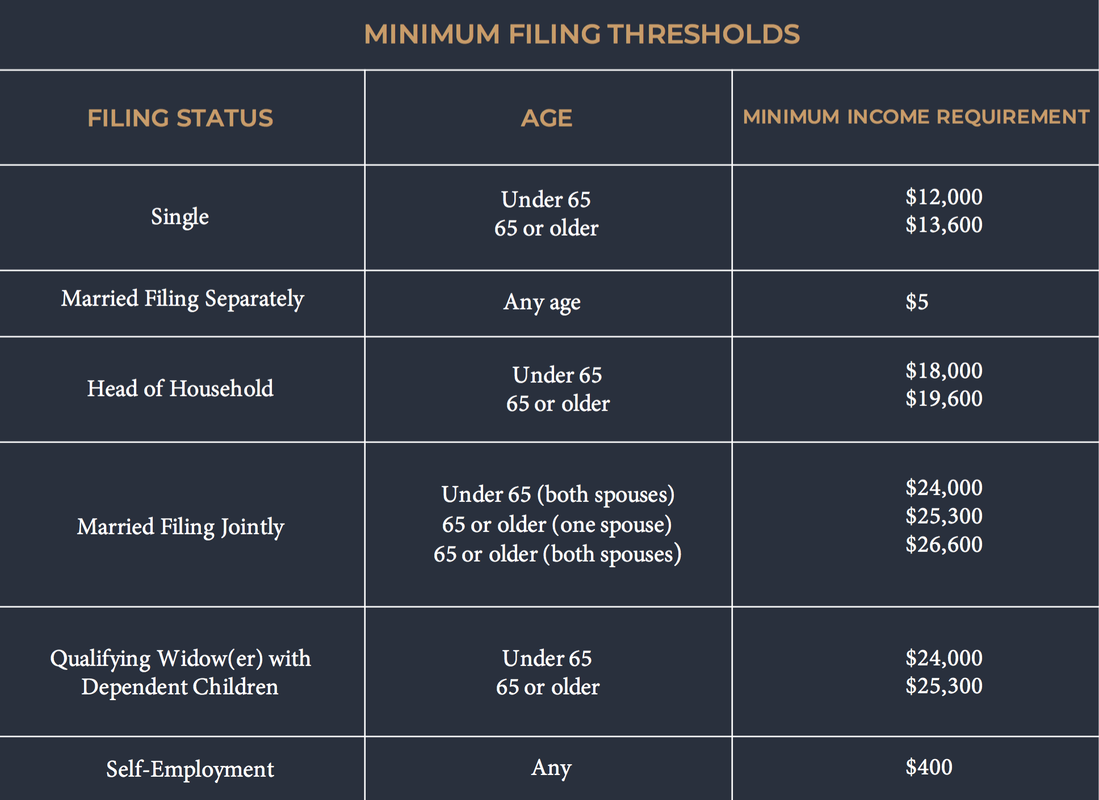

U.S. Federal Tax Filing Requirements: 1. Employees with income exceeding $10,000/month 2. Self-employed individuals with income exceeding $400/month. Deadline: Any taxes due must be paid by April 15th, just like back in the U.S. Filing deadline is June 15th, with a further extension available until October 15th. Other requirements: 1. FBAR: must be filed for individuals with a combined balance exceeding $10,000 in accounts outside of the U.S. 2. Form 8938: must be attached to the annual return of individuals with foreign assets exceeding $200,000, excluding a home owned in your name (FATCA requirement). Now, let’s look at some of the best U.S. expat tax saving strategies: Foreign Earned Income Exclusion (FEIE) allows you to exclude around $100,000 of foreign earned income from U.S. tax liability. - FEIE can be claimed using form 2555. This is a tremendous benefit, and one that most who are living overseas are able to take advantage of. Foreign Tax Credit prevents you from paying tax twice on your foreign income. It allows you to claim a dollar of income for every dollar of tax you’ve already paid in your country of residence, and can be claimed alongside the FEIE. However, it sometimes makes more sense to claim just one. Renting a home abroad: You can claim housing expenses, including rent, utility bills, insurance and parking as deductions normally up to a maximum value of 30% of the FEIE. The aforementioned deductions are not automatic and in order for you to benefit from the great number of exclusions available, your tax return must be prepared correctly and tax saving tools utilized properly. Minimum Income Requirements Based on Age and Status There is no minimum income set for filing a return. Amount varied both according to both filing status and age. Listed below in the chart, you can see the minimum taxable income level for each group. Note: It is advised to file. Not doing so may be bad , especially if you could use money the following holiday season. Without filing a return, refunds cannot be claimed. There are various reasons why a refund might be due to you. Want to find out how your situation looks? Do not hesitate to contact us and we will provide you with expert guidance. Are you interested in learning more about tax saving strategies as an expat? Do not hesitate to contact us. Click on read more to navigate to our O&G Blog and find additional information on the new tax laws in China and back in the U.S. Read more: 1. Case Study: How will China's New Tax Laws Affect Me? 2. The Hidden Cost of Repatriating Money 3. IRA & 401(k) 2019 Update Disclosure: O&G Capital Management and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed