|

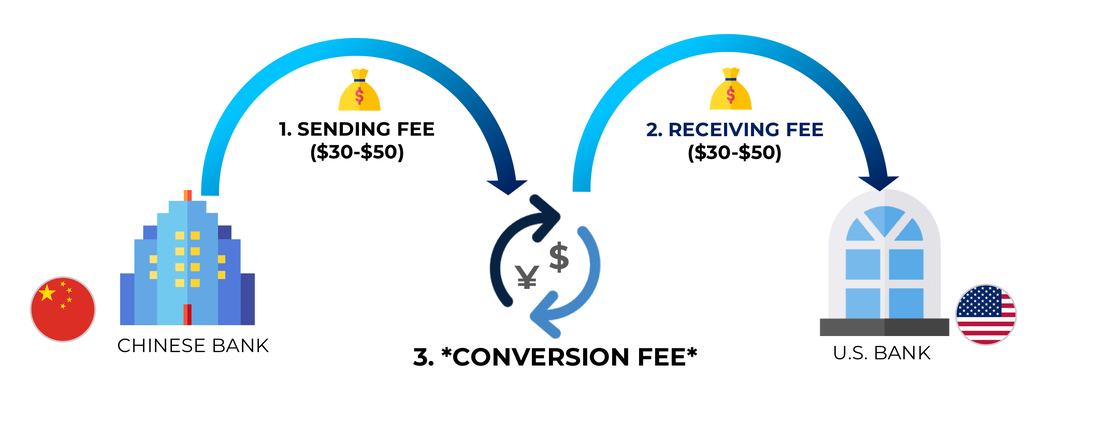

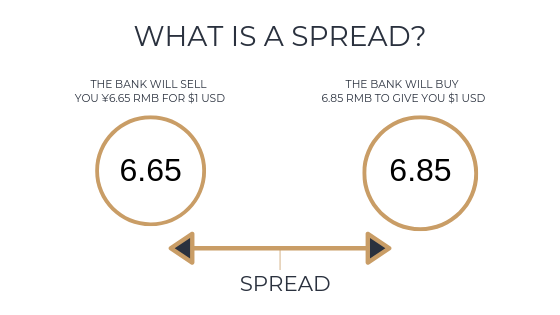

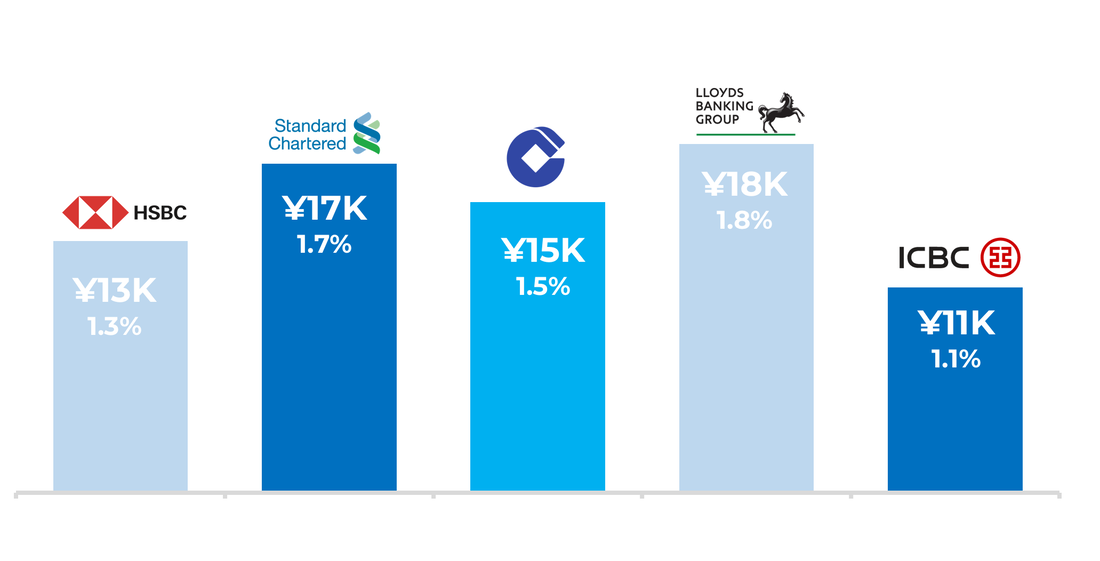

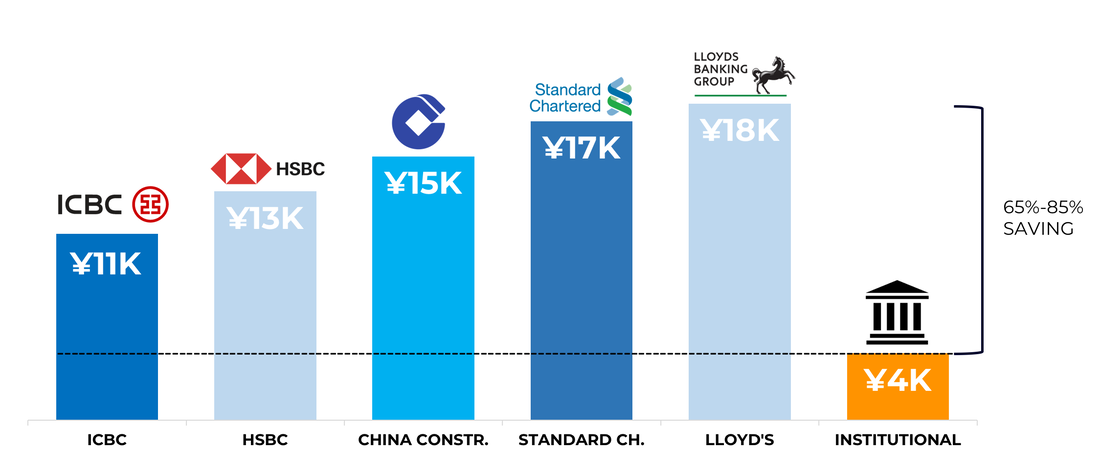

Sending fee, receiving fee and conversion fee. The common denominator is that they are unwanted and unavoidable. But what can you actually do to minimize these costs? When you send money abroad it would be profits from your company, payments to suppliers, or for personal reasons. When doing this, you must make a conversion from RMB to your home currency. HOW DOES REPATRIATION WORK?Your bank branch might offer you a compelling way to repatriate your funds overseas and possibly waive transaction fees for the sake of relations and your satisfaction. As you do this, the bank will give you a ‘spread’. The spread is the price at which they are willing to exchange the money for – it is here, where your bank will make their most substantial and hidden profits. By digging deeper into the transactional structure, we can easily explain how spreads are the bane of the retail currency exchange market and give recommendations on how you can mitigate the impact of these spreads on your wallet. When Googling your way to today’s exchange rate for USD/RMB, you would find that the real rate is 6.75 meaning that for $1 USD you’d pay 6.75 RMB. When going to the bank, they will offer you a spread with an average fee of 1.5%. This means that they would sell you 6.65 RMB for $1 USD or buy 6.85 RMB to give you $1 USD. Remembering that the real rate is 6.75, you would now be paying an undisclosed fee on your exchange. As an example, sending 10,000,000 RMB from China to the U.S. with aforementioned bank rate would mean a conversion fee of $21.627 USD which goes to the bank. Cost To Convert ¥1M RMBIn comes ‘institutional spread rates’. An institutional rate is offered by banks to large companies where the spread gets reduced by 65-85%. Where the rate for you was 6.85 an institutional rate would be 6.77 meaning the conversion fee on the same amount would now only be $4.376 USD. Cost To Convert ¥1M RMBTo get better rates, we suggest speaking with your banker or by switching banks. Before transferring money, compare the spreads of several banks, and find the lowest. You should be bargaining down your fee to around 1.1%. Would you like institutional rates, speak with O&G about setting up an Institutional Platform. While more complex, the potential savings are significant. On average, we minimize the fees by 75%.

Reach us at: Shanghai, China: +86.131.2206.9291 Boston, USA: +1.508.598.7590 [email protected] Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed