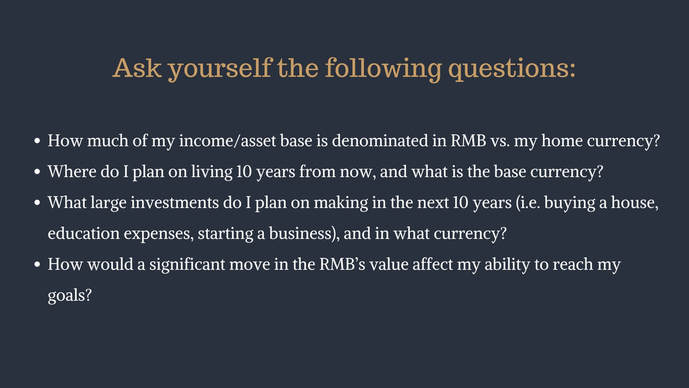

The Fluctuating RMBI came to China for the first time in 2006 and immediately began soaking up the country’s rich culture, people, and cuisine. I took the 8:1 USD/CNY exchange rate for granted, and accepted strong dollars as being one of the many perks of life abroad. After spending the next five years in the states to finish school, I returned to China in 2013 to find the exchange rate had shifted to 6:1, the USD had declined in relative value by 25%! Flash-forward to today and the USD has bounced all the way back up to about 7:1. While complex macroeconomic forces drive these fluctuations, their implications affect us as expats. This article aims to simplify how we got here, and how you can prepare for future exchange rate fluctuations. Preparing for the Coming Decade Proper planning and diversification can reduce currency risk dramatically for yourself or your firm. Get Started: A high amount of flexibility is offered to foreigners who want to manage their currency exposure onshore. If you need to convert some assets into your local currencies, many local banks can assist you.

The process of developing and implementing a plan can be daunting, and O&G Capital is here to help. We help our clients save money by developing actionable plans and offering professional guidance to both individuals and companies. Please don’t hesitate to reach out for a complimentary one-on-one analysis. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed