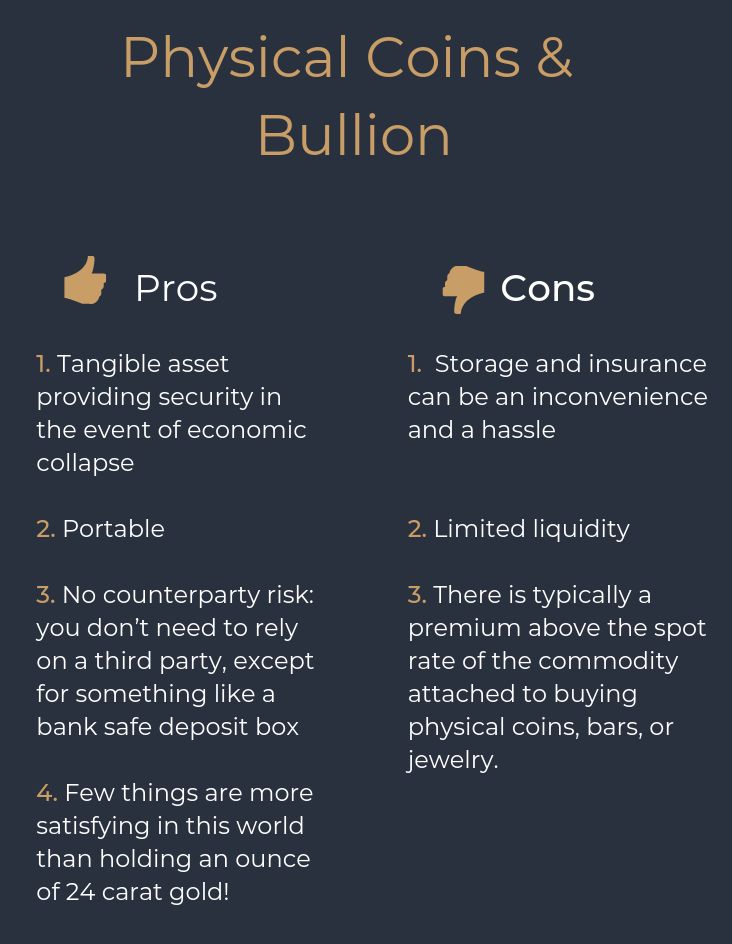

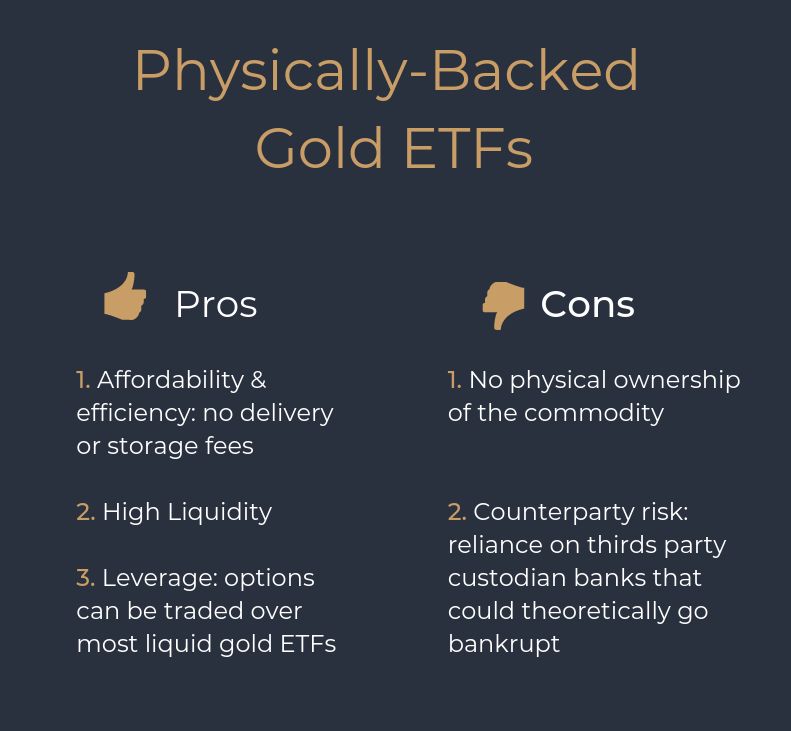

The Gold Standard Serving as the basis of economic capitalism, gold has always played a major role in the global economy. Although not a primary currency anymore, gold can be used as an integral tool in your portfolio and carries a variety of benefits: Store of Value & Inflation Hedge Compared to the USD that has lost 98% of its purchasing power since the Federal Reserve was established, physical gold has preserved value by consistently beating inflation. Unlike fiat and cryptocurrencies, gold is a tangible asset that cannot be hacked, forged or erased. Diversification Having a small portion of your portfolio dedicated to gold is an effective way to maintain a balanced portfolio over an economic cycle. Hedge against market crashes Gold has proven to balance equity losses during downturns, with the commodity rising nearly 70% of the time that stock markets fell over the past 50 years (across all 12 month periods). Where to Start: Physical Gold vs. Physically-Backed Gold ETFs Physical ownership and owning an ETF can be seen as two complementary options, and diversification between both would minimize the inherent risks of each. Another effective method is to purchase shares of the companies/stocks that are involved in the mining and production of gold. These stocks are typically highly leveraged to the commodity. For example, the price of gold has increased in value by about 9% since September of 2018, while the gold miner ETF has increased 27%. Be aware that this outperformance can be expected on the downside as well, and that proper due diligence should be done before any investments are made. "Gold will be around, gold will be money when the dollar and the euro and the yuan and the ringgit are mere memories." — Richard Russell The use of options and futures tied to the commodity are another way to obtain a high degree of leverage to the price of gold. It’s important to be aware of the risks associated with leverage, and trading on margin, when considering these options.

Gold and other precious metals can be used as an important component to a well-balanced long-term plan. Please reach out if you’re interested in learning more about how gold can be incorporated into yours. Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed