Two sectors stood out on Wednesday -- financials and industrials. They were the only sectors to register a gain or loss of more than 1.0%, closing higher by 1.5% and 1.1%, respectively. Consumer staples was the weakest sector, losing 0.7%, but no other group advanced or declined more than 0.5%. The financial sector was helped by Warren Buffet's Berkshire Hathaway (BRK.B 200.44, +10.03), which rallied 5.3% after eliminating a restriction on its ability to buy back its own shares. Morgan Stanley (MS 50.56, +1.38) was also a positive influence, climbing 2.8% on better-than-expected Q2 results. U.S. Bancorp (USB 50.72, -0.58) declined 1.1%, however, despite beating bottom-line estimates. In other corporate news, the EU hit Alphabet (GOOG 1195.88, -2.92) with a $5 billion antitrust fine for allegedly using its Android mobile operating system to stifle competition. Google already said it will aggressively fight the verdict, but the EU antitrust commission has been successfully targeting US technology companies in recent years because of their dominant market position. Google forces smartphone makers to pre-install all of its Google apps on their Android devices, helping them maintain their market share of the search market, which stands at over 80%. Source: Briefing.com

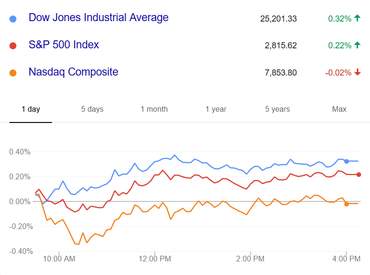

Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed