|

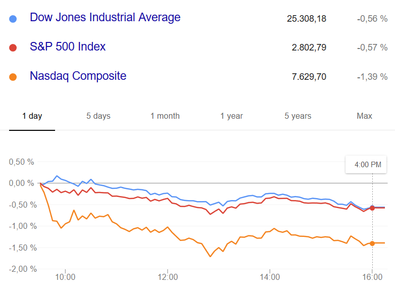

Stocks dropped for a third straight session on Monday, with tech shares again pacing the retreat. Both the S&P 500 and the Dow Jones Industrial Average lost 0.6% apiece, while the tech-heavy Nasdaq Composite tumbled 1.4%. The averages opened flat, but slipped into the afternoon, settling just above session lows. The technology sector -- which is the heaviest sector by weight, representing a quarter of the broader market -- was undoubtedly the worst-performing group on Monday, losing 1.8%. More than half of its components shed at least 1.0%, with Twitter (TWTR 31.38, -2.74) losing 8.0%, Netflix (NFLX 334.96, -20.25) dropping 5.7%, and Facebook (FB 171.06, -3.83) tumbling 2.2%. Monday's tech tumble followed similar declines on Thursday and Friday -- which were set in motion by Facebook's 19% plunge last Thursday following disappointing earnings/guidance -- and points to continued profit taking following a strong run ahead of earnings season; the tech sector added 7.9% from July 3 to July 25. Elsewhere, Amazon (AMZN 1779.22, -38.05, -2.1%) fell with its FAANG peers, helping to secure a loss for the consumer discretionary sector (-0.8%). The industrial sector (-0.9%) also struggled following an intraday reversal from Caterpillar (CAT 139.75, -2.81), which went from +2.8% to -2.0% despite reporting upbeat earnings and guidance. Away from equities, U.S. Treasuries finished flat to modestly lower, pushing the back end of the yield curve slightly higher; the yield on the benchmark 10-yr Treasury note climbed two basis points to 2.98%. Meanwhile, the U.S. Dollar Index dropped 0.3% to 94.16, and the CBOE Volatility Index spiked 8.8% to 14.19, a three-week high. Source: Briefing.com

Graph: Google Finance Comments are closed.

|

About the O&G Research TeamThe O&G Research Team publishes insights on the global markets. Our research scope ranges from the US to China. Categories

All

Follow us on WeChat:

Read new articles and updates everyday on your phone!

DisclosuresWe may invest in some of the companies mentioned on this website. We are not responsible for the content on any external links on this website. The opinions expressed in this report do not constitute a buy or sell recommendation.

|

RSS Feed

RSS Feed